Employer-Sponsored Insurance Tax Exemption

The tax exclusion of employer-sponsored insurance (ESI) has made it the primary source of health-insurance coverage in the United States.

During World War II, as statutory wage and price controls were in effect, many employers competed to attract workers by offering health-care benefits. The Internal Revenue Service determined that these benefits should be exempt from income taxation.[1]

The share of the U.S. households subject to income taxes rose from 7% in 1939 to 68% in 1955, and the proportion of the population with private health insurance soared from 9% in 1940 to 61% in 1955.[2]

Congress subsequently embraced the tax exemption of ESI as a means of expanding health-insurance coverage without assuming the entire cost. Unlike universal publicly funded health care, privately funded health insurance is automatically responsive to growing demand. Nor is it limited to the services that can affordably be provided universally. It also averts the need for comprehensive regulation over the provision of medical services, which collective purchasing by the government would have required. Finally, using tax exemptions also tends to strengthen incentives for able-bodied adults to work, rather than diminishing the incentives.

Since the Affordable Care Act’s employer mandate went into effect in 2016, businesses with at least 50 full-time employees have been subject to a penalty according to the number of employees to whom they fail to provide “affordable” comprehensive health-insurance coverage. The mandate, however, was designed more to protect the status quo than to expand the provision of health-insurance coverage. The share of the population covered by ESI rose only from 48.6% in 2014 to 49.4% in 2018, due mostly to a macroeconomic recovery.[3] There is no mandate to cover dependents of workers. But because the tax exemption for ESI is worth almost three times as much to those covering their families, dependents account for about half of those covered by ESI.[4]

Firms may not deny workers health-insurance coverage according to their medical status. This provision guarantees coverage of employees with preexisting medical conditions and prevents plans from excluding workers with costlier health-care needs.[5] But the purchase of health insurance by employers has various drawbacks, which have become more significant as the cost of coverage has risen as a share of workers’ compensation. Plans purchased by firms often poorly fit the wide variety of workers’ needs and circumstances.[6] In order to cover treatment at medical facilities preferred by all employees, plans must have very broad networks, which allows providers to insist on inflated prices for procedures. While 73% of individuals opt for health plans with narrow networks, only 9% of employers offer narrow network plans.[7]

In general, cost controls tend to be unpopular under ESI, as any savings accrue to the firm, while reductions in access to care are borne by staff. This caused a backlash to the development of managed care, which had succeeded in reducing the utilization of wasteful services.[8] A 2020 study for the Centers for Medicare and Medicaid Services found that the cost of care delivered to enrollees on the individual market was 27% less than that received by individuals with equivalent medical needs who were enrolled in employer-sponsored plans.[9]

The tax exemption for ESI has succeeded in getting those capable of working to provide health insurance for themselves. But when insurance is tied to employment, individuals are at risk of losing coverage and access to their preferred medical providers if their employment circumstances change for any reason.

The uniformity of the tax subsidies and premiums for ESI mean that federal aid is not varied according to need and that lower-paid workers often remained uninsured—even if they are offered coverage by their employers. Some 81% of those of working age in households with incomes above 400% of the federal poverty level (FPL) receive health-care coverage from employers, compared with only 15% of those with incomes less than 100% of FPL.[10]

Affordable Care Act Tax Credit

The individual market has traditionally been a residual market for those who lack an offer of ESI or eligibility for public entitlement programs—typically filling in gaps between more stable employment arrangements. Most enrollees remain on plans for less than a year.[11] Within such a short time frame, it may be hard to fully insure individuals against the risk of developing major medical conditions, as knowledge of chronic conditions will often exist before the purchase of coverage.[12]

The Affordable Care Act (ACA) of 2010 sought to address this problem by requiring insurers to provide the same comprehensive health-care benefit packages to all potential enrollees, with premiums set the same for enrollees who signed up before or after they got sick. This encouraged individuals to wait until they developed elevated medical needs before enrolling—causing the average cost of coverage to more than double from 2013 to 2017, as the reforms came into effect.[13] By the fall of 2016, many insurers had dropped out of the marketplace altogether, leaving 1,036 of the 3,007 counties in the nation with only a single insurer on the individual market.[14]

ACA initially sought to coerce those reluctant to purchase plans, but there was little political will to punish uninsured individuals, who typically had little ability to afford them. As a result, the legislation’s “individual mandate” penalty was slight, exempted most of those who failed to purchase coverage, and had little effect—even before it was repealed altogether in 2017.[15]

As a self-financing competitive insurance market with plans that enrollees are actually willing to pay for, ACA’s individual market largely collapsed. But the presence of subsidies—which expand automatically, as necessary, to guarantee a defined benefit to low- and middle-income Americans—has prevented it from entirely succumbing to a death spiral.

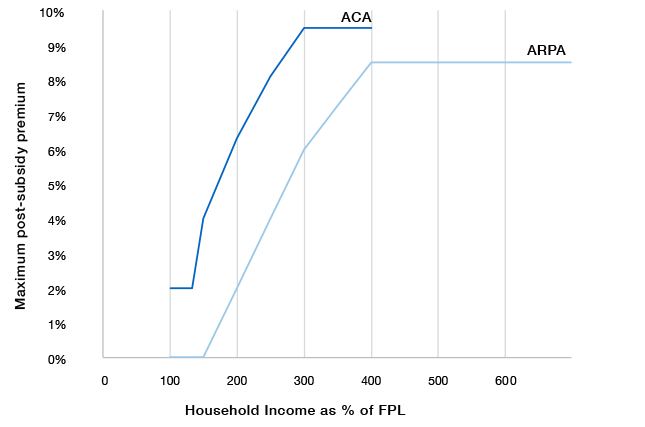

Figure 1

Premium limit guaranteed by Advance Premium Tax Credit

KEY NUMBERS: Federal Poverty Level in 2022

- Individuals: $13,590

- Family of 4: $27,750

From 2015 to 2018, while the number of unsubsidized individual market enrollees plummeted from 9.4 million to 5.2 million, enrollment in subsidized exchange plans increased slightly, from 8.0 million to 8.6 million.[16] Without subsidized enrollees and federal overpayments for subsidized healthy enrollees, which indirectly cross-subsidize the nominally unsubsidized, it has been estimated that individual market enrollment would fall by 80%.[17]

ACA provides an entitlement to Advance Premium Tax Credit (APTC) subsidies, as necessary, in order to reduce net premiums for benchmark plans on the ACA-regulated individual market to maximum levels specified as a percentage of household income (Figure 1).[18] Individuals are eligible if their households lacked an offer of “affordable” ESI and had incomes between 100% and 400% of FPL.

The American Rescue Plan Act (ARPA) of 2021 greatly expanded these subsidies.[19] Under ARPA, the cost of premiums for enrollees with incomes of 100%–150% of FPL is fully assumed by the federal government, and subsidies are increased to absorb a larger share of premiums for those earning 150%–400% of FPL. ARPA also expanded eligibility for subsidies to limit premiums to 8.5% of income to everyone, regardless of income level.

ARPA is currently scheduled to expire at the end of 2022, which would restore subsidies to their ACA levels. But Congress is considering extending the subsidy increases beyond that deadline.

In practice, the value of APTC subsidies depends on their interaction with unsubsidized premiums on the individual market.[20] Under ACA, insurers are allowed to vary premiums according to enrollees’ age, by a ratio of up to three to one, in order to cover the higher expected medical costs of older enrollees. But the cap on post-subsidy premiums does not vary according to age. As a result, under ARPA, many younger enrollees will still receive no subsidies, even if they have incomes of less than 400% of FPL, while older workers earning more than 800% of the poverty level may receive substantial subsidies (Figure 2).

Figure 2

Average individual market premiums before and after subsidies, by household characteristics

Source: DCHL, CCIO, and KFF[21]

The expansion of subsidies under ARPA was, in many cases, substantial. For a 28-year-old earning $40,000, federal subsidies under ACA would have covered 22% of the cost of insurance; under ARPA, subsidies cover 61%.[22] With the income cap on eligibility for subsidies removed by ARPA, all could potentially receive aid if premiums rose high enough. In absolute terms, the subsidy increase was largest for older workers earning slightly more than 400% of FPL, who had previously been unsubsidized and fully exposed to costs associated with age rating.

Subsidies that increase automatically in proportion to premiums reduce the price sensitivity of insurance purchasers, weakening competition and increasing costs.[23] This problem is exacerbated by interaction with ACA’s community-rating rules, whereby an increase in unsubsidized premiums tends to further reduce the proportion of price-sensitive healthier individuals enrolled.

This inflationary impact of subsidies is further aggravated by weak competition, with half of counties having only one or two insurers offering ACA plans in 2021.[24] In counties with only a single insurer, ARPA comes close to an open-ended commitment to providing $1 in additional federal subsidies for every $1 that insurers increase prices. Nationwide, one study estimated that 53% of spending on subsidies was captured by insurers in higher prices.[25]

Individuals earning $20,000 had been required to contribute up to 4% of their income in premiums under the original ACA; but under ARPA, the federal government picks up the whole tab. The establishment of zero-premium plans potentially creates a bonanza for insurers to enroll individuals who never have had interest in purchasing or using health insurance, while further diminishing insurers’ incentive to check the costs that medical providers may bill them for.

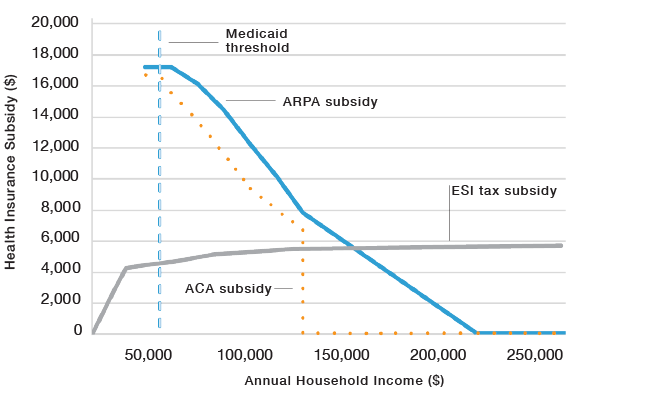

Figure 3

Average annual tax subsidies for family coverage

Source: CCIO, KFF, and JCT[26]

Tax Subsidy Disparities

The magnitude of APTC subsidies can be understood by reference to the implicit tax subsidy for ESI—the value of its exemption from federal income and payroll taxes. To avoid distortions associated with the interaction of tax subsidies and ESI nondiscrimination and ACA age-rating regulations, this is best done by comparing tax subsidies for family coverage at various income levels.

Beyond the level where household earnings exceed the employer contribution to health insurance, the implicit tax subsidy for ESI is fairly uniform as a dollar amount, with respect to income (Figure 3). But ACA and ARPA tax credits for insurance purchased on the exchange diminish as income increases. At lower levels of income, the tax subsidy greatly exceeds that for ESI.

Just above the 400% of FPL cutoff for ACA subsidies, subsidies under ARPA slightly exceed the value of the ESI tax exemption. At the highest income levels, the tax subsidy for employer coverage remains similar in dollar terms, while that for the purchase of exchange plans falls to zero.

For a typical family of four with a household income of $80,000, the tax subsidy for ESI would be worth about $4,000. Under ACA, if that family purchased a plan on the exchange, they would receive subsidies of about $9,000. ARPA expanded this to about $12,000.[27]

Prior to ACA, in 2013, only 16 million Americans purchased health insurance from the individual market, but 149 million were covered by their employers.[28] To prevent workers from fleeing ESI to claim much greater APTC subsidies, ACA established a provision known as the “employer firewall,” which prohibited workers with an offer of “affordable” ESI from receiving APTC.[29]

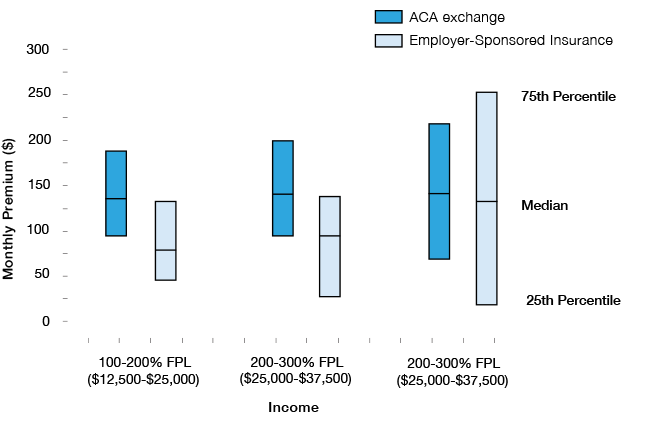

Figure 4

Post-subsidy premiums, single adults

Source: MEPS (2019)[30]

This was a reasonable method to ensure that ACA’s increase in expenditure would be used to extend insurance to those who lacked coverage altogether, even if it was unfair to those with an offer of ESI. But ARPA’s further increase in APTC subsidy inflates the privileges that the small group enrolled in the exchange received, rather than ameliorating the situation of those who were excluded due to an offer of employer-sponsored coverage—a much larger group, which is in greater need of assistance.

Even before ARPA’s expansion of subsidies, subsidized exchange plans charged substantially lower premiums to low-income households than ESI did. This was true of all income cohorts below 400% of FPL, and the disparity was largest for the lowest income group (Figure 4). Due to additional cost-sharing reduction (CSR) subsidies for exchange plans, low-income workers enrolled on the individual market also paid much less in deductibles and out-of-pocket costs than those receiving ESI.[31]

Making ARPA’s increase in APTCs permanent would cost $220 billion over the first 10 years.[32] It would be significantly higher—and thus politically impossible—if the vast majority of low-income workers were not excluded by the employer firewall. Instead of expanding the subsidies arbitrarily reserved to a small group that already receives disproportionately generous aid, policymakers should instead design subsidies to assist those who need help most, at levels that would be fiscally affordable across the board.

Aligning Assistance

The tax exemption for ESI coverage has succeeded in nudging firms to provide health-insurance coverage for most workers and their dependents. The tax credits for the purchase of insurance from ACA’s exchange provides a safety net of coverage for those who lack an offer of employer-sponsored insurance.

But neither source of coverage is appropriately responsive to policyholders’ needs for cost-effective care. ESI costs are bloated by the need to simultaneously satisfy all employees with loose networks and broad benefit packages, while the cost of ACA plans is inflated by the requirement that all enrollees pay the same premiums as those who sign up only after they get sick. It is therefore desirable to restructure tax subsidies to help households opt for more cost-effective insurance plans.[33]

A step in this direction came with the 2019 Individual Coverage Health Reimbursement Account rule, which enabled workers to benefit from the ESI tax exclusion while purchasing their own coverage from ACA’s exchange. The rule also allowed employers to place up to $1,800 in ICHRAs to purchase non-ACA health-insurance coverage.[34] But that is likely not enough to cover the cost of full coverage for dependents or the relatively higher premiums that those in older age groups might face.

The ICHRA rule was a step in the right direction, but Congress should go further to help individuals purchase health-insurance plans. To make available more affordable coverage, it should establish a new Continuous Renewable Insurance (CRI) market, where Americans could buy guaranteed renewable insurance priced in proportion to their medical risks.[35] Congress should support the CRI market with tax advantages that would allow it to compete with ESI and ACA plans.

Figure 5

Proposed tax credit for Continuous Renewable Insurance

Households with incomes of less than 400% of FPL and no offer of ESI coverage should be allowed to claim tax credits worth 70% of the value of the orginal ACA subsidies to which they are entitled, for the purchase of CRI coverage (Figure 5). The value of these subsidies should be adjusted for age, the enrollment of dependents, and an otherwise ordinary level of medical risk. Given the lower premiums that individuals can receive from the CRI market by signing up before they get sick, this would leave them better off, while also reducing costs to the Treasury.

Households with incomes above 400% of FPL who lack an offer of ESI coverage are ordinarily ineligible for ESI or ACA tax subsidies. This accounts for much of the anxiety caused by the “subsidy cliff ” where eligibility for ACA subsidies is cut off. ARPA expanded premium-linked subsidies to this group, but the result has been more inflation of costs across the board.

A better way to help those without ACA subsidies would be to give individuals at all income levels the option of deducting 70% of the cost of health-insurance purchases for themselves and their dependents (from ACA or CRI markets) from their taxable income.[36] This would remedy the inequity for those falling on the wrong side of the subsidy cliff and revive incentives for price competition among insurers—while avoiding the inflationary and fiscally costly consequences of an open-ended commitment to automatically absorb a dollar of premium increases for higher earners with a dollar of additional subsidies.

Table 1: Proposed Changes

Endnotes