Graphic supply: Getty Illustrations or photos

Well being insurance is a person of the biggest head aches for any HR division and compact company. There are so lots of uncertainties about what type of system to give, how a lot it will price tag, how to administer the prepare, and no matter whether you even are demanded to give a approach.

It doesn’t assist that the principles and restrictions have adjusted so a great deal in the latest decades, from the introduction of the Economical Treatment Act (ACA) by President Barack Obama in 2010, to attempts to repeal the act by the current administration, to the influence of the approaching election on wellbeing insurance coverage plans.

For modest businesses seeking to stay on the suitable aspect of the law while running prices and striving to maintain employees satisfied and balanced, this is all a whole lot to choose in. That is why we have established this manual that addresses tiny business enterprise healthcare needs and touches on the applicable wellness insurance policies regulations.

1. What do smaller business house owners will need to know about well being insurance needs?

Some organizations are necessary by law to deliver wellness insurance coverage, even though some are exempt. We’ll dive into these exemptions underneath, but there are fundamental needs when it comes to providing health insurance policies to your workforce.

To begin with, when you present a health and fitness coverage plan, it must satisfy the gain, protection, and affordability expectations set out in the ACA. You also have to offer all eligible workers some variety of overall health insurance coverage inside of the very first 90 times of their employment.

2. Do small corporations have to offer wellness insurance policies under the ACA?

Compact organizations that have much less than 50 complete-time employees (or the equivalent in section-time workers) do not have to give wellness insurance coverage less than the ACA, which is occasionally referred to as Obamacare.

Given that most compact firms have under 50 workers, this indicates most are exempt. If you have additional than 50 comprehensive-time employees, you are expected by regulation to deliver wellbeing insurance policy.

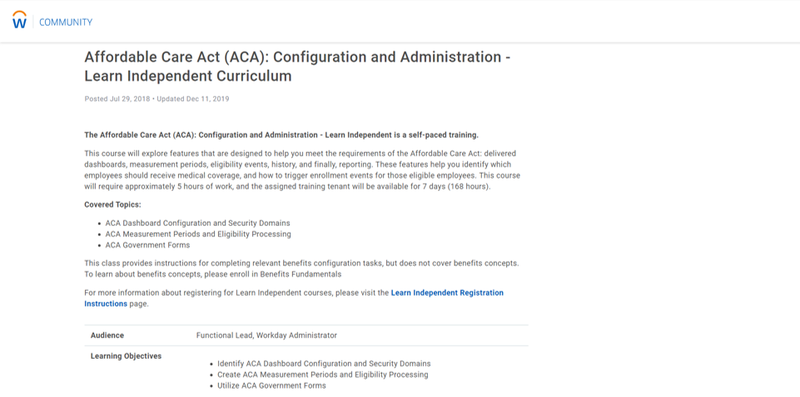

The caveat to this is that legal guidelines do change, particularly as political administrations modify, so it is significant to have measures in area to preserve up with the hottest restrictions. This could imply subscribing to market publications and newsletters, consulting with authorized specialists, or even reading your HR computer software vendor’s weblogs. The HR software Workday even presents teaching on dealing with the ACA.

Workday’s totally free education can help you get up to pace with the ACA. Picture resource: Author

3. What benefits are there to offering wellness insurance?

Even though you are below no authorized obligation as a little business to deliver well being insurance coverage, there are a selection of motives why you must take into account it.

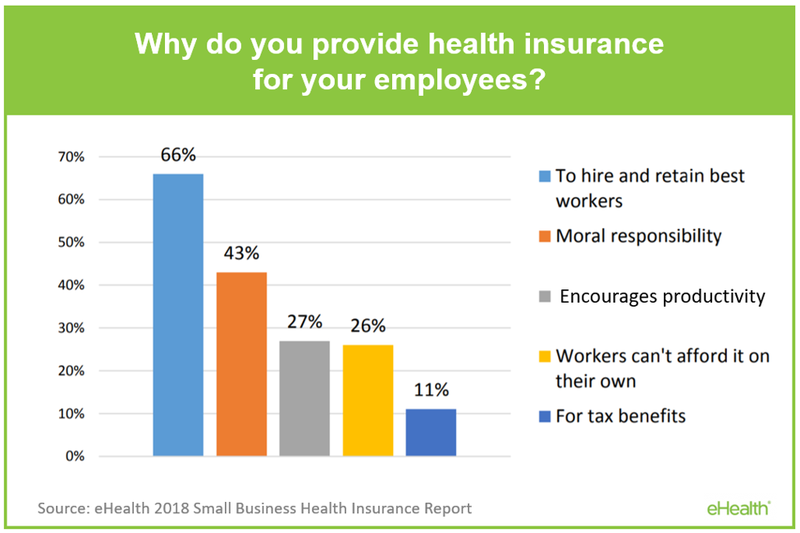

Providing wellness insurance policies will help you bring in talent, as individuals prioritize gains deals when browsing for careers. As a small enterprise, you may not be ready to provide the identical payment as significant enterprises, but you can make up for that by offering interesting added benefits, this sort of as wellness insurance policy. In reality, two-thirds of firms deliver overall health insurance plan as a way to entice and retain employees.

Businesses usually offer you wellbeing insurance to attract and keep expertise. Impression supply: Writer

Also, a healthful workforce is a delighted workforce, and prevention is greater than needing to discover a cure. Providing wellness insurance coverage shows staff members that you treatment about their properly-staying, boosting morale, improving satisfaction, and helping keep expertise.

You also want to encourage your employees to glance following their overall health — both bodily and mental — as health issues-similar dropped efficiency fees US businesses about $530 billion per yr.

There are also financial rewards to delivering well being insurance. You can typically deduct your contributions from your taxes, and there are also tax breaks that are available on a state-by-condition foundation.

If you use the Modest Organization Health and fitness Solutions Method (Shop) Marketplace to buy your wellbeing insurance policy, you may possibly also be eligible for federal tax breaks or tax credits.

4. How can I purchase a wellness insurance coverage prepare?

There is more than 1 way to obtain a health coverage approach. Below are the most well known for modest organizations:

- Team well being insurance coverage programs: You can obtain these strategies by the federally operate Shop Marketplace. This was the most common option for little enterprises in the previous, but because of to the higher expenditures and lack of flexibility, this is no for a longer time an alternative for many companies.

- Skilled small employer well being reimbursement arrangement (QSEHRA): Set up by Congress in December 2016, QSEHRA is getting an more and more well-known selection for small businesses. Underneath this arrangement, enterprises offer staff a tax-no cost month-to-month allowance, and staff members then opt for and pay for their have health and fitness treatment applying that money. The advantages of QESHRA are that it offers staff the versatility to opt for their possess plan and it is significantly less difficult to manage from an administrative issue of see.

- Association wellness strategies: Little companies can sign up for with other little providers to invest in large-group health coverage (which is reserved for corporations with much more than 50 employees). This will work in the exact way as a standard group health and fitness insurance coverage plan.

5. How a lot of staff do you need to qualify for team well being insurance?

Group health and fitness insurance policies is a expense-powerful way for small enterprises to offer health insurance policy, as it is less costly than getting specific ideas.

A corporation has to have fewer than 50 personnel to qualify for group wellness insurance. You also have to have an place of work of some type (even if it is only a desk in a coworking area) in the condition the place you are making use of for coverage, and you want to enroll at least 70% of your uninsured personnel.

If you are a family-operate business enterprise, you need to examine your eligibility for team overall health insurance plan, as you have to have to have staff who are not related to or the wife or husband of the owner of the organization. If you only employ family customers, you are going to need to have to use for a spouse and children health insurance policies plan as an alternative. Sole proprietors also are not able to implement for team health insurance policies.

Element-time employees and seasonal employees do not count as element of the group, but you can continue to decide on to supply them group wellbeing insurance c

overage. You can also provide person overall health insurance plan to distinct staff along with your group prepare.

6. What is the bare minimum employer contribution for wellness insurance policies?

If you meet the needs and you decide for a team wellbeing insurance policy program, you have to pay out at least fifty percent of the month to month well being insurance coverage rates. You also have to permit staff to address their dependent children till they are 26, even if they do not live at household.

Having said that, if you purchase well being insurance coverage by the QSEHRA, there are no minimum contribution needs, and you can make your mind up how considerably to give every single worker every for every thirty day period.

7. Do compact-business enterprise employers have to report wellness insurance on Type W-2?

Underneath the ACA, employers have to report the charge of coverage below an employer-sponsored team wellbeing prepare on an employee’s Kind W-2. The cost claimed should really contain each the amount compensated by the employer and the quantity compensated by the employee. You really do not have to report dental, eyesight, legal responsibility insurance policy, and wellness systems on these sorts.

Although you have to report well being insurance plan fees on this form, that doesn’t indicate that this contribution is taxable. Numerous organizations are in fact suitable for tax reduction from these contributions.

8. The place can I get support to control my overall health coverage plan?

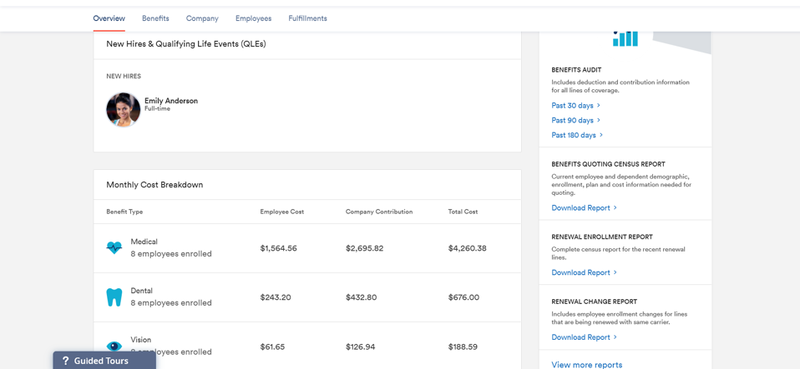

Once you’ve decided on a modest employer well being coverage program, you nevertheless have to administer this approach and make sure that it is cost-efficient and satisfies the vital needs. Which is wherever HR software can help.

If you opt for a answer like Zenefits, you can acquire perception into how a great deal your added benefits are costing you, additionally how a lot of workforce are enrolled in your well being insurance plan strategy. You can also give employees entry to a self-provider portal to support them have an understanding of more about the system and conveniently enroll in it.

Zenefits supplies insight into the value of the added benefits you provide workers. Image supply: Writer

Stay ahead of the activity

Furnishing overall health insurance policy to workers can be highly-priced, time-consuming, and complicated, but it can also be helpful when it comes to attracting and retaining expertise, boosting worker morale and gratification, and strengthening efficiency levels. You have to have to weigh the selections and make your mind up on a way forward that is best for your small business.

Communicate to legal experts, see what your staff think about whether or not health insurance coverage is a precedence, and look for guidance from your HR computer software seller, as they should really have significant practical experience in rewards administration. And then do what is ideal for you to be able to run your business enterprise easily. It’s an significant conclusion, so really do not hurry it.